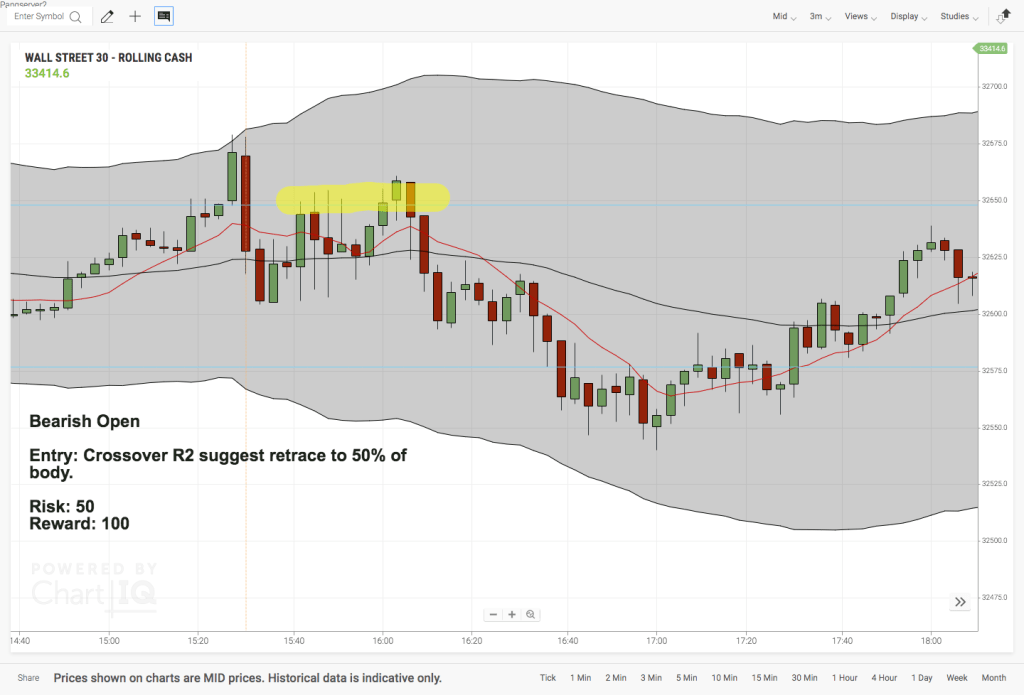

This strategy creates a trading opportunity based on the initial movement of the Dow or US30 index futures right after market open. The theory builds on statistics showing the index creating a high or low for the day – or at least for the first 90 minutes of trading – timed at the open. This probability can be matched and fine-tuned when the nature of the first 2, 3, 5 or 15 minute candle is established. The typical risk-reward ratio is around 1:2. There are certain exceptions to this high probability setup. Exceptions take place during high volatility, violent moves outside of Keltner channels, lack of market direction (doji candlesticks) and other situations such as overlapping risk events in near future.

While the setup is very mechanical and easy to perform the challenging part is to find the optimal entry in achievement of optimal risk-reward-ratios. Without this the setup is not overly rewarding.

Leave a Reply